Income Tax

Filing Income Tax Returns

Filing income tax in Canada can be easy. The 3 videos we created above present an overview of Canadian tax and why it’s important for all Canadians to file taxes on time, how the Community Volunteer Income Tax Program (CVITP) could be of help to you, and what documents you will need ready when filing your tax.

New Journey Housing is hosting free tax clinics starting in March until April 2024.

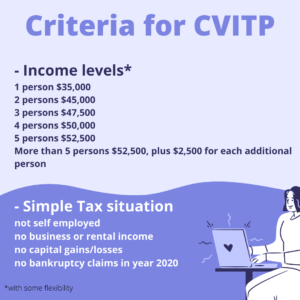

We can file your 2023 income taxes if:

1. you are born outside of Canada, 2. you are living in Winnipeg, and 3. you have a simple tax situation (no business income, no final returns, no bankruptcy).

Choose 1 of 2 ways to file your income tax with us:

1. make an appointment to drop off your tax information at our office. This will take 15-20 minutes of filling out an intake form. We will phone you after 3-5 days or as soon as we finish filing your returns, and send you back your tax files by Canada Post.

Drop off appointments can be made for Mondays, Tuesdays, Thursdays and Fridays– 9:30 AM to 4 PM.

OR

2. make an appointment to file your taxes in-person at our office. You will meet with a tax volunteer for an hour . In-person tax filing clinic is on March 9th and 23rd, and April 6th and 20th from 10 AM — 2 PM.

To make an appointment, call 204-942-2238 and look for Tarek or Ireen, OR email us at ireenb@newjourneyhousing.com. Tell us which of the 2 methods above you want to file your taxes, and the day and time you prefer.

Before you make an appointment, please make sure all your tax documents are ready.

See list of tax documents: click here

New Journey Housing is careful to keep your information confidential and secure.

==================

IF you haven’t filed other past years’ tax returns (2022 and earlier),

we may help you file those as well! Email ireenb@newjourneyhousing.com for information.

==================

SOME MORE INFORMATION: Visit Canada Revenue Agency for information about eligibility in the CVITP program here: https://www.canada.ca/en/revenue-agency/services/tax/individuals/community-volunteer-income-tax-program/need-a-hand-complete-your-tax-return.html

If you would like to file your own individual tax returns, click here for CRA-certified tax software that you could use: https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/efile-electronic-filers/efile-certified-software-efile-program.html

OFFICE LOCATION

New Journey Housing

200-305 Broadway Winnipeg MB R3C 3J7

(Corner of Broadway and Donald on the 2nd floor)

OFFICE HOURS

Monday to Friday: 9:30 am – 5:00 pm

Phone: 204-942-2238

Fax: 204-942-2239

E-mail: info@newjourneyhousing.com